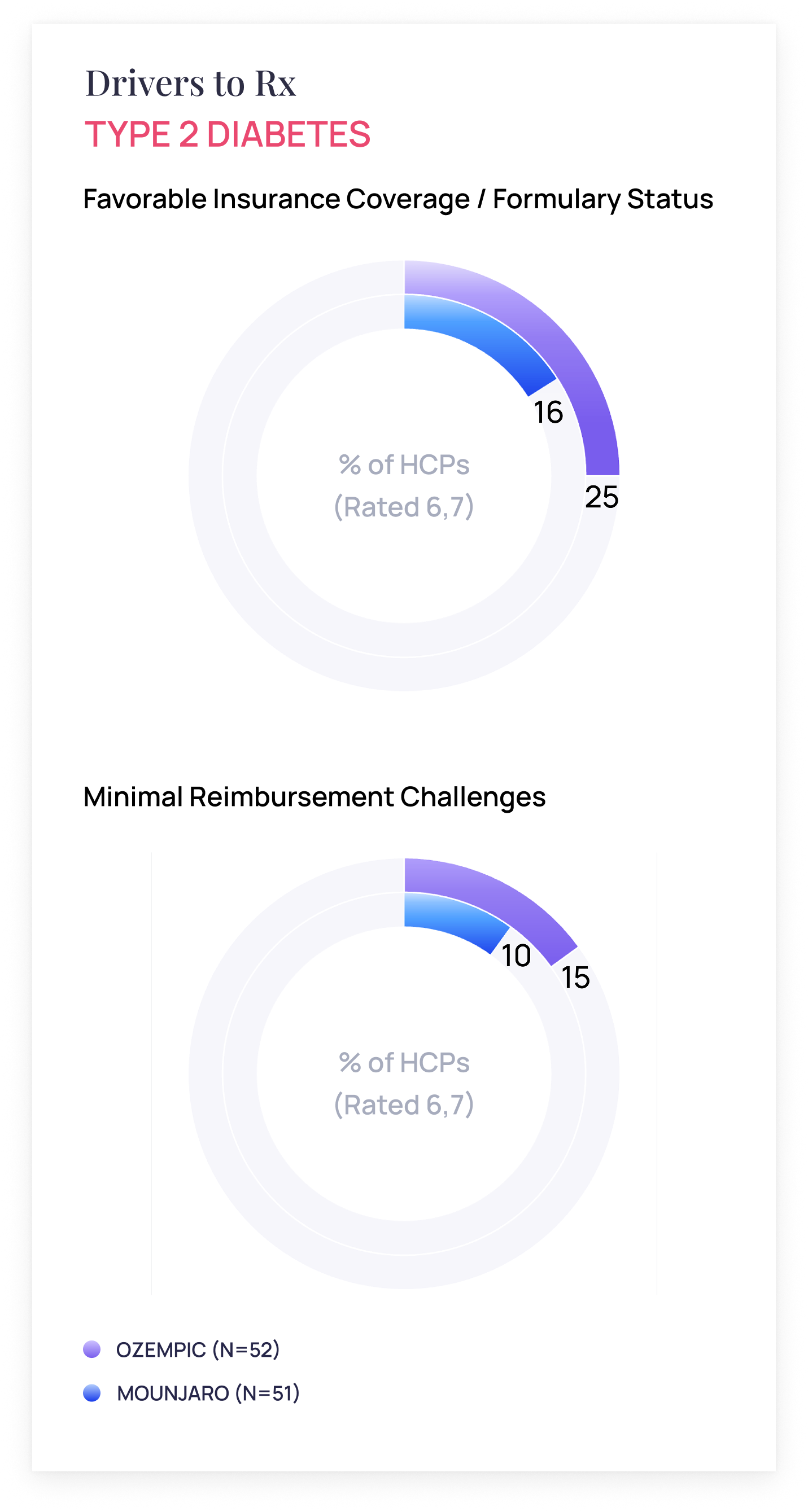

HCP Insights

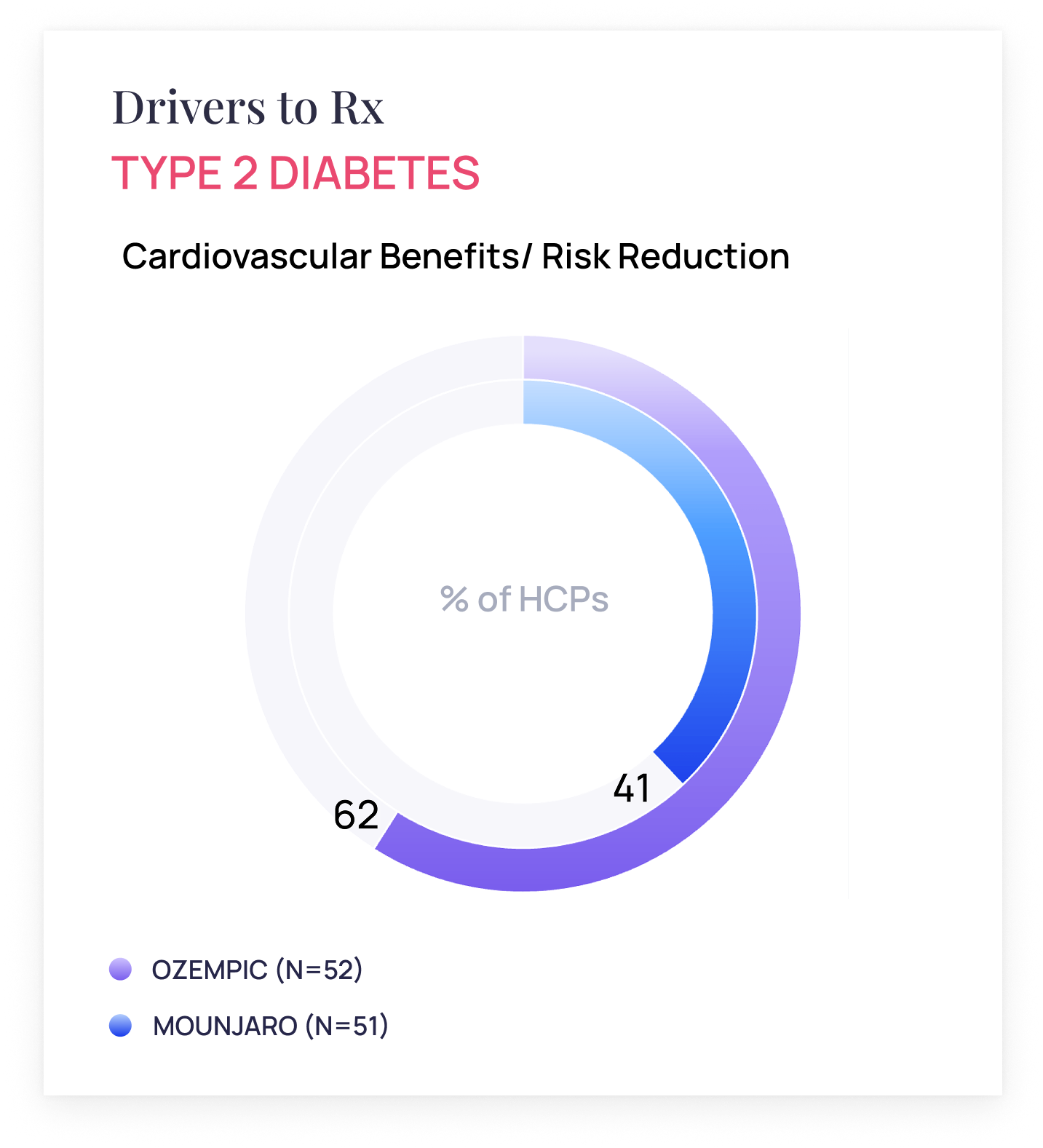

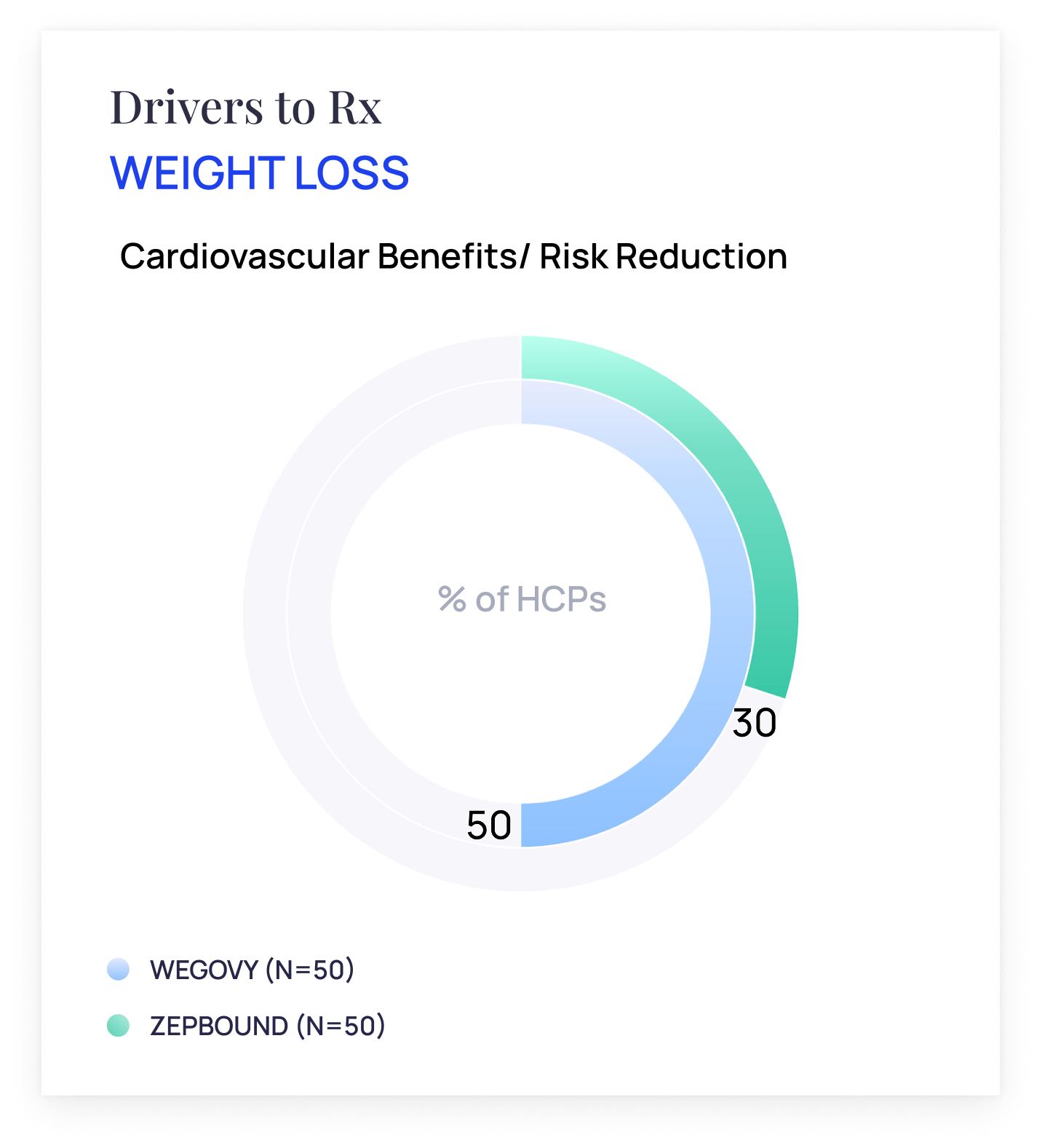

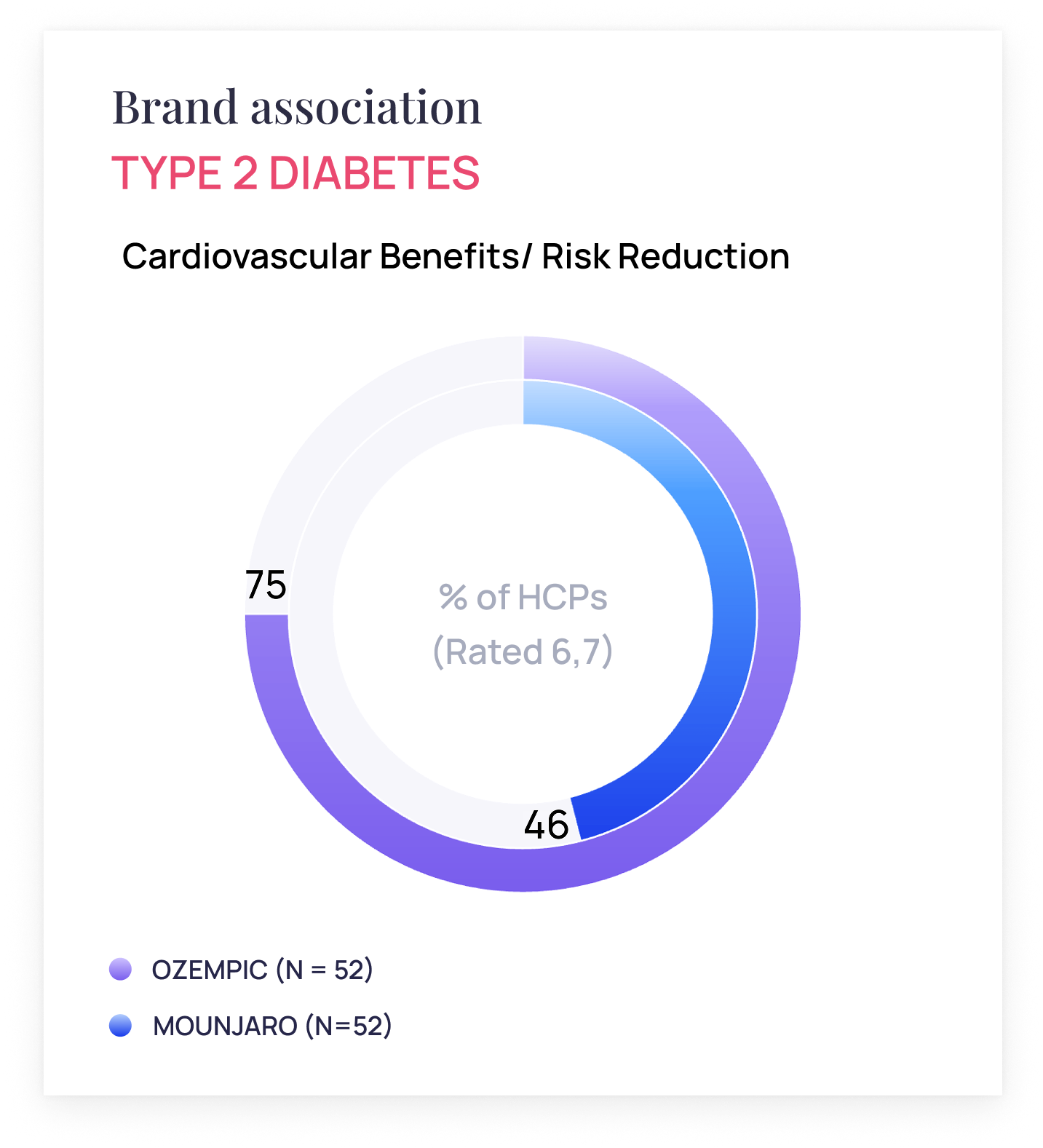

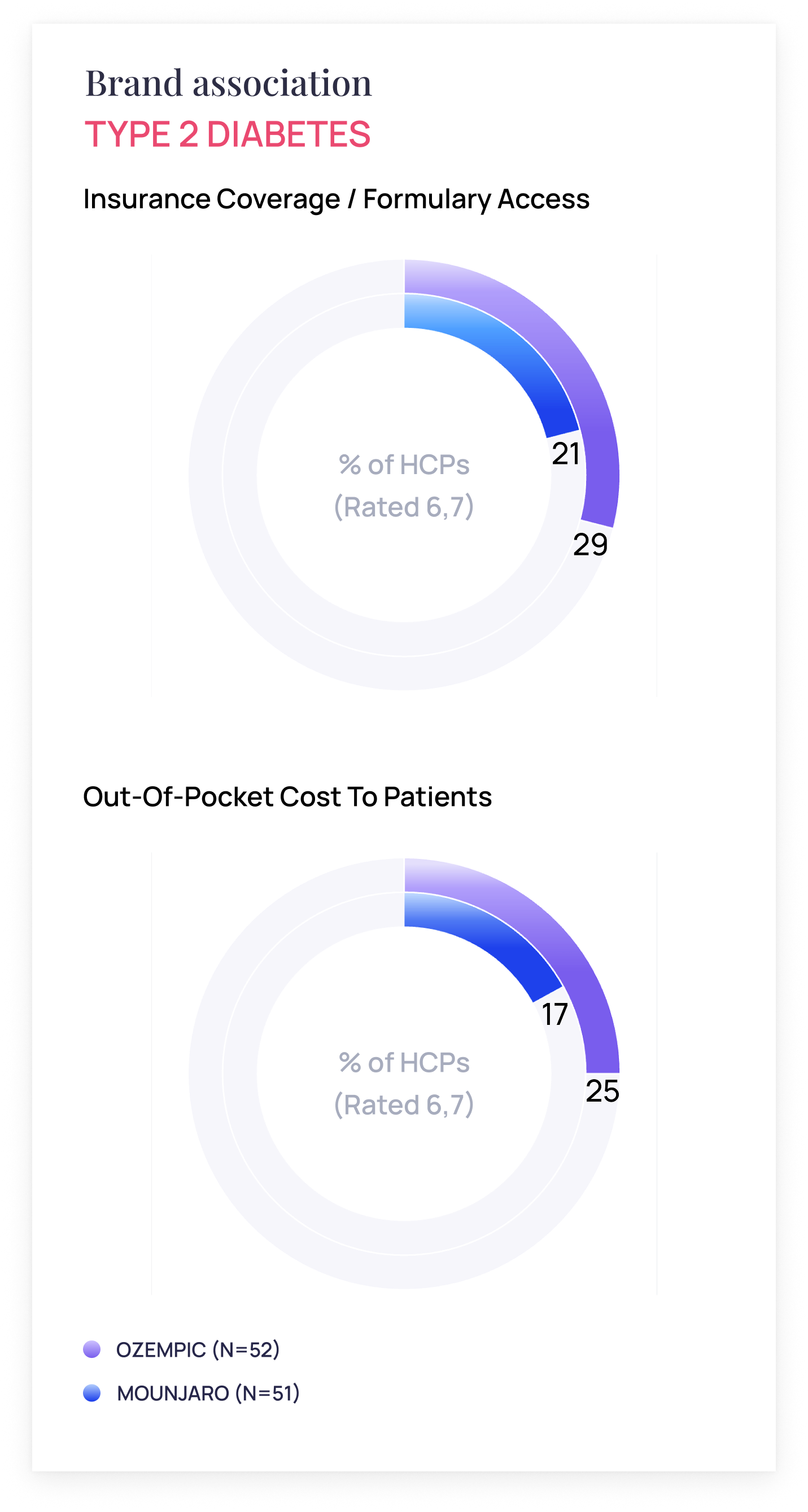

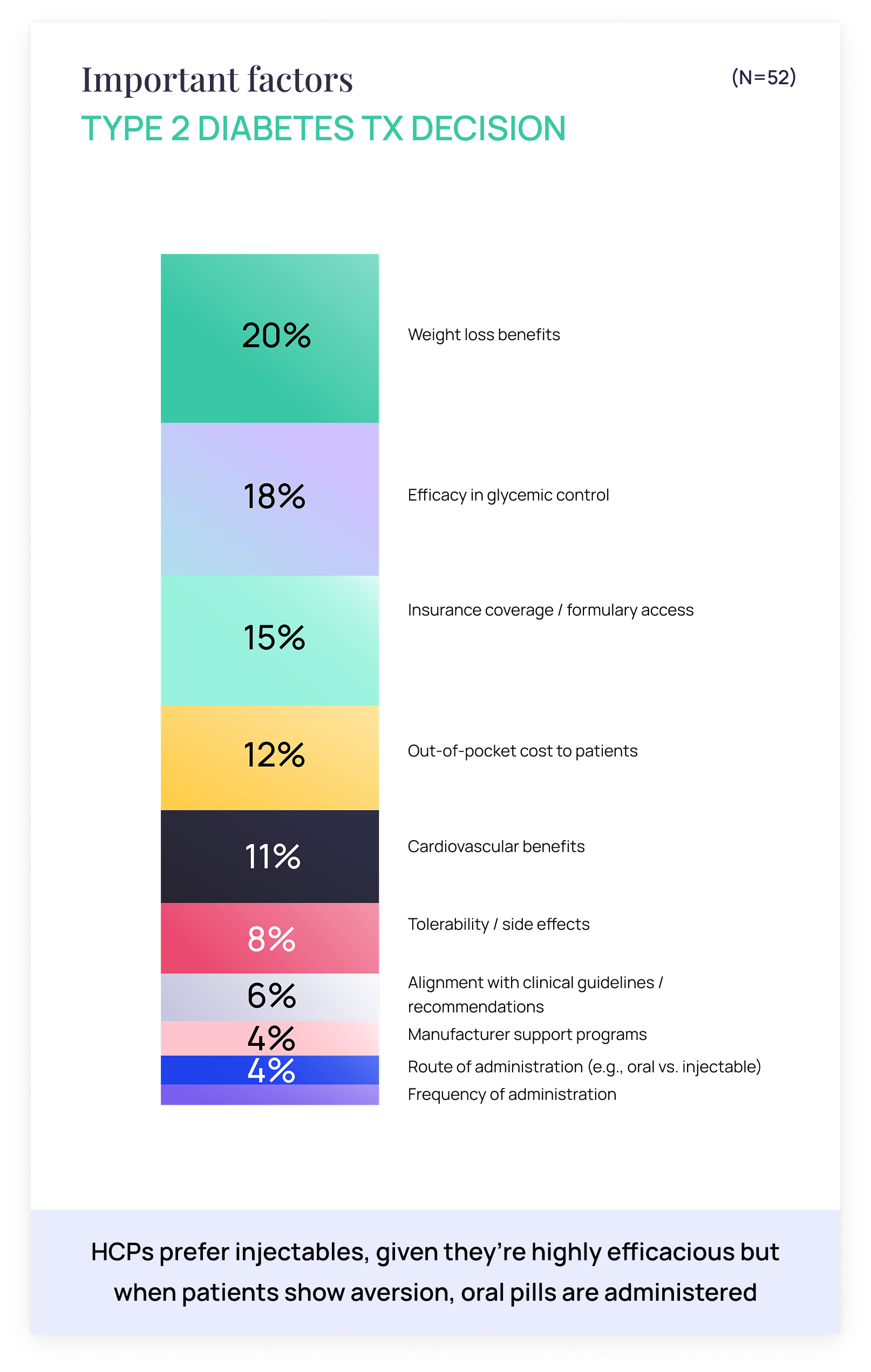

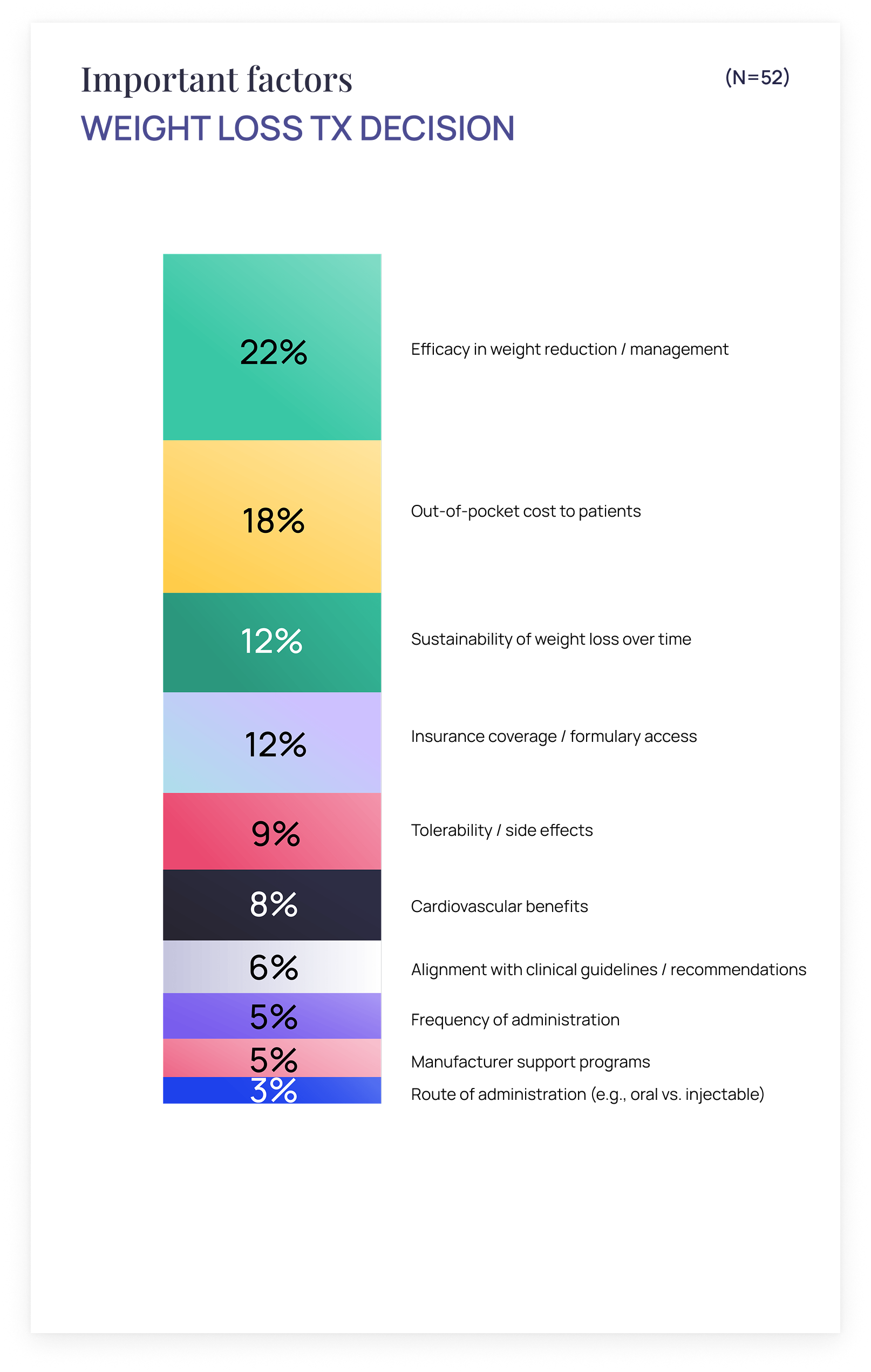

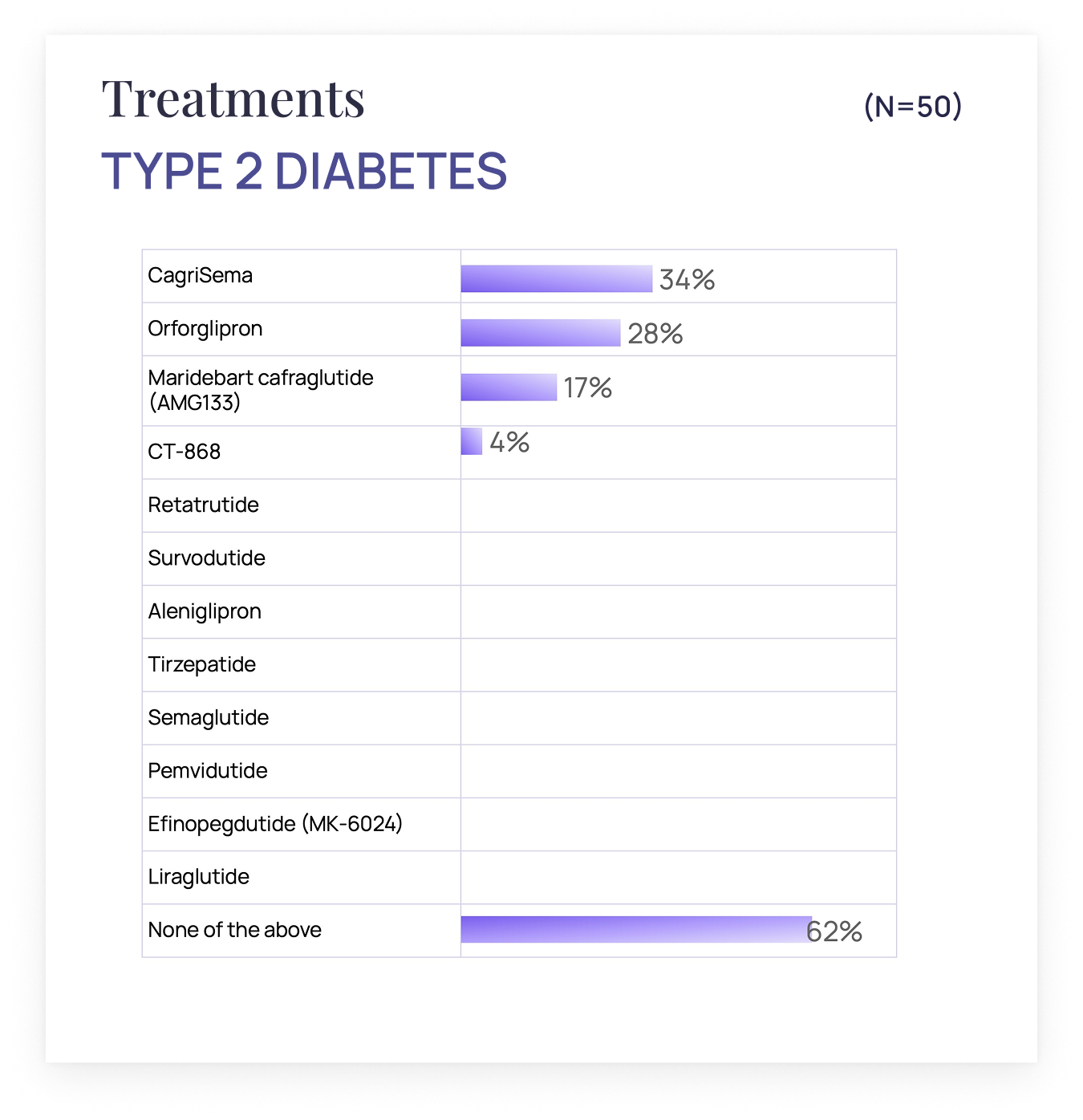

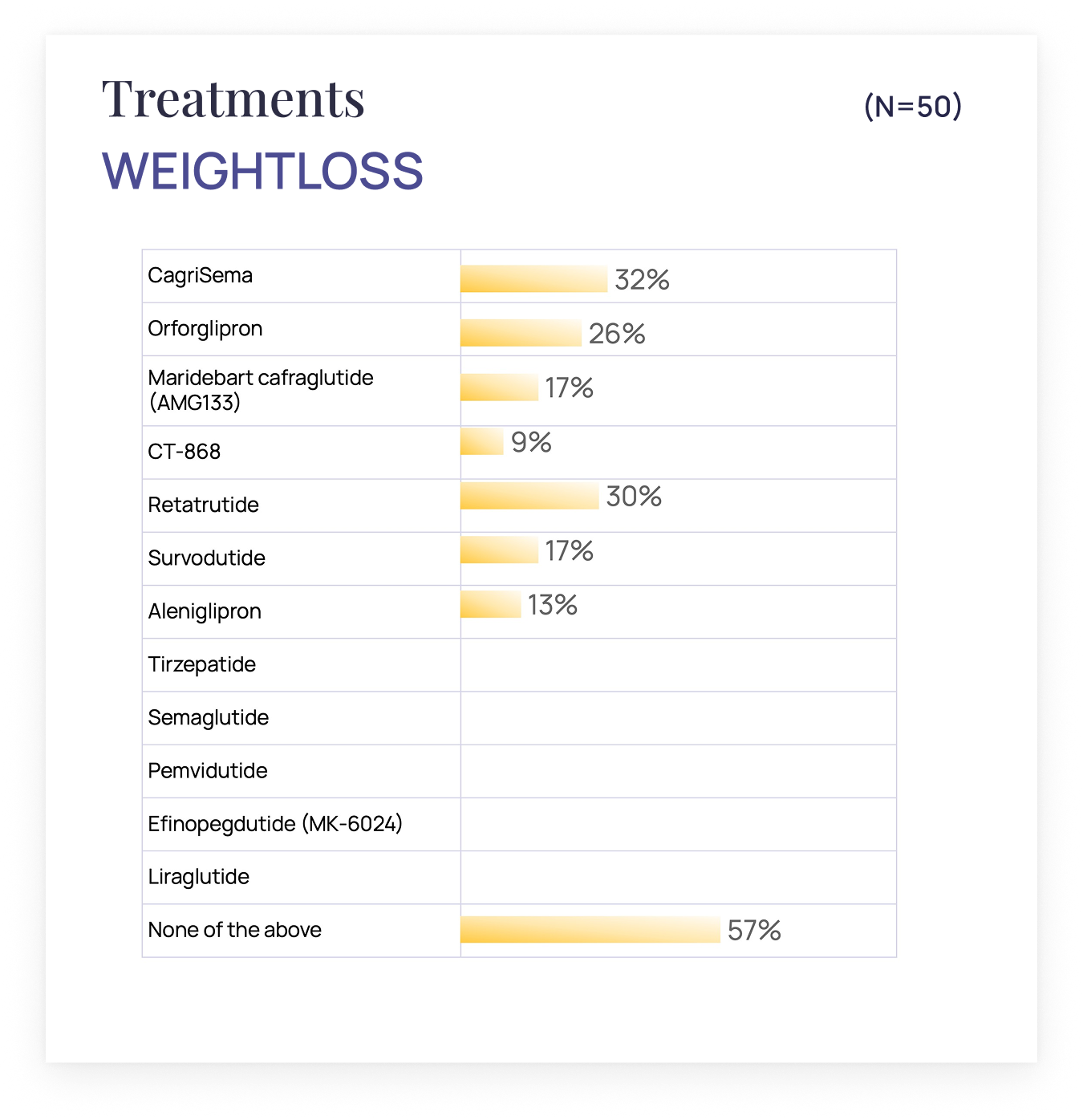

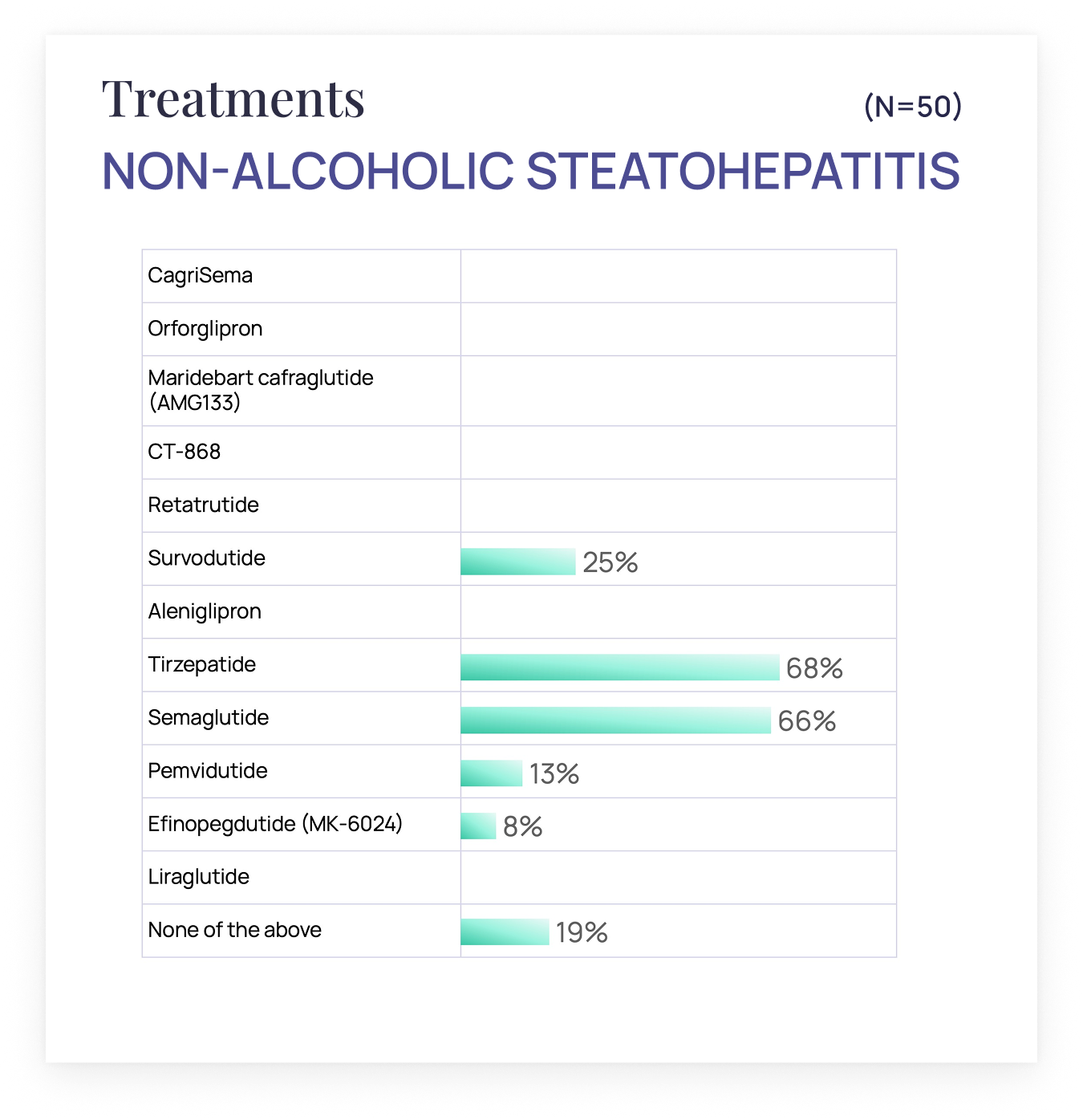

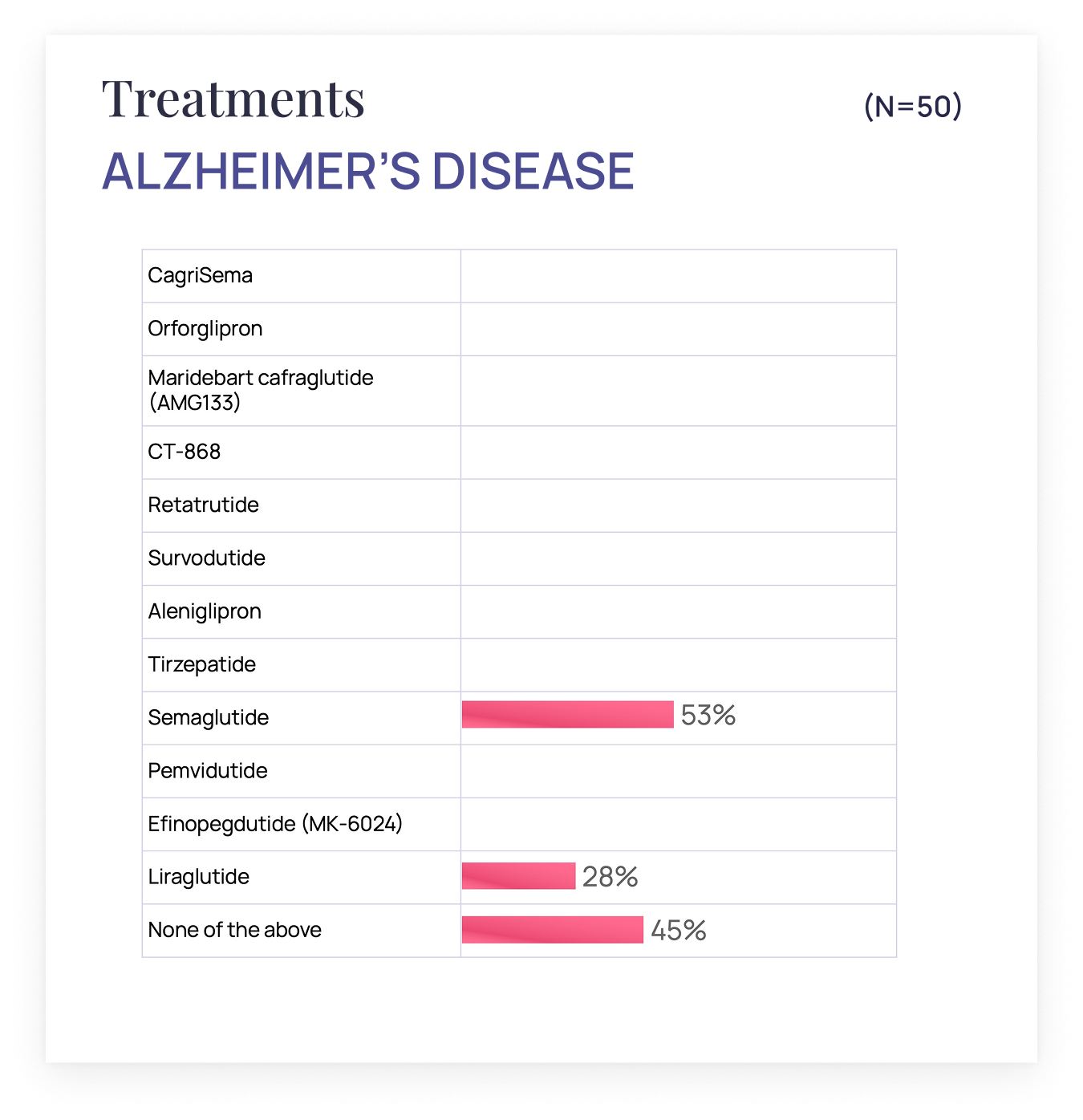

This study assesses healthcare providers' awareness, usage, and perceptions of GLP-1 therapies for type 2 diabetes and weight management. It explores the clinical, logistical, and economic factors that influence their prescribing decisions.