HCP Digital Reach

(Q2 '24 – Q1'25)

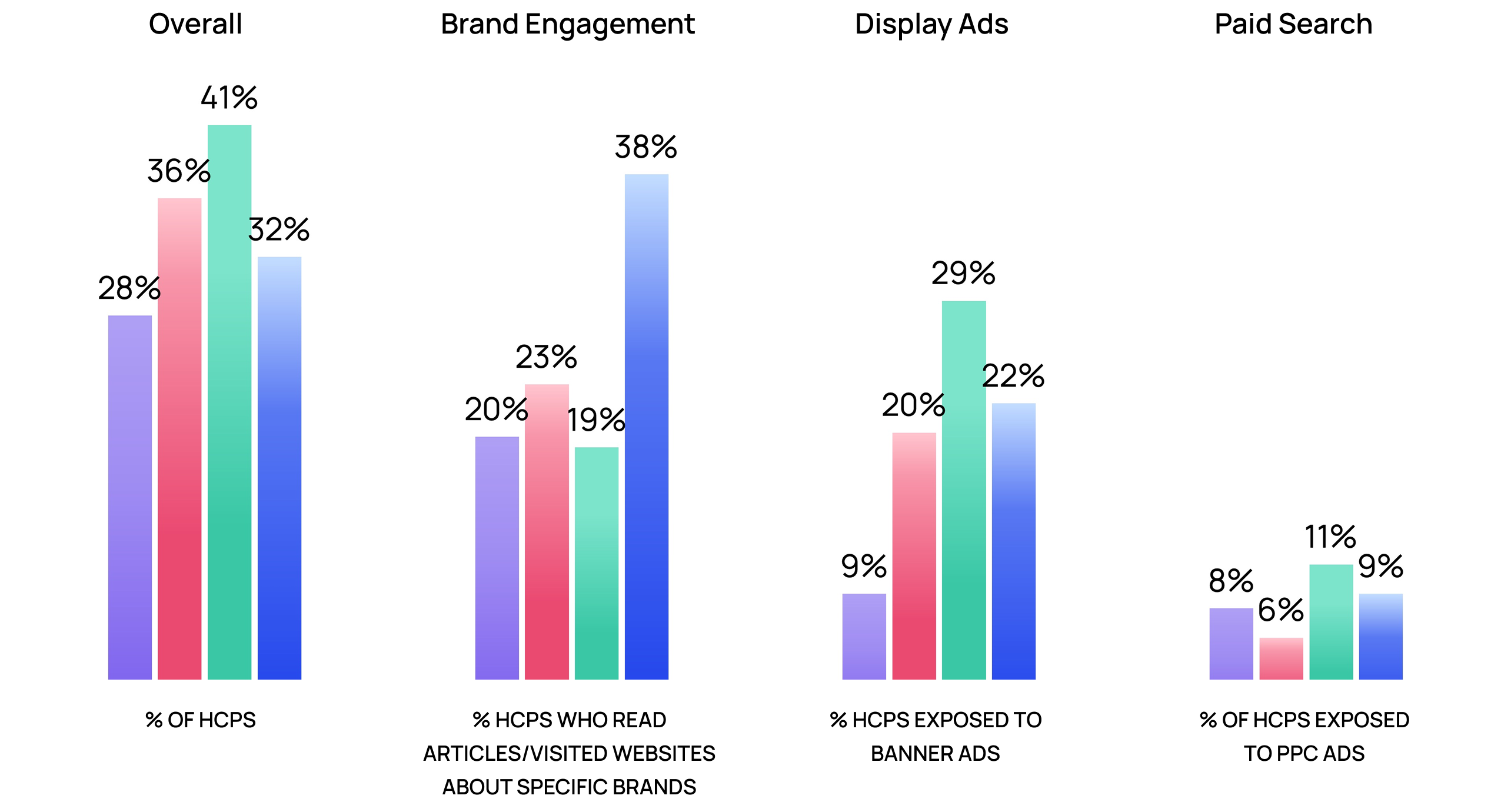

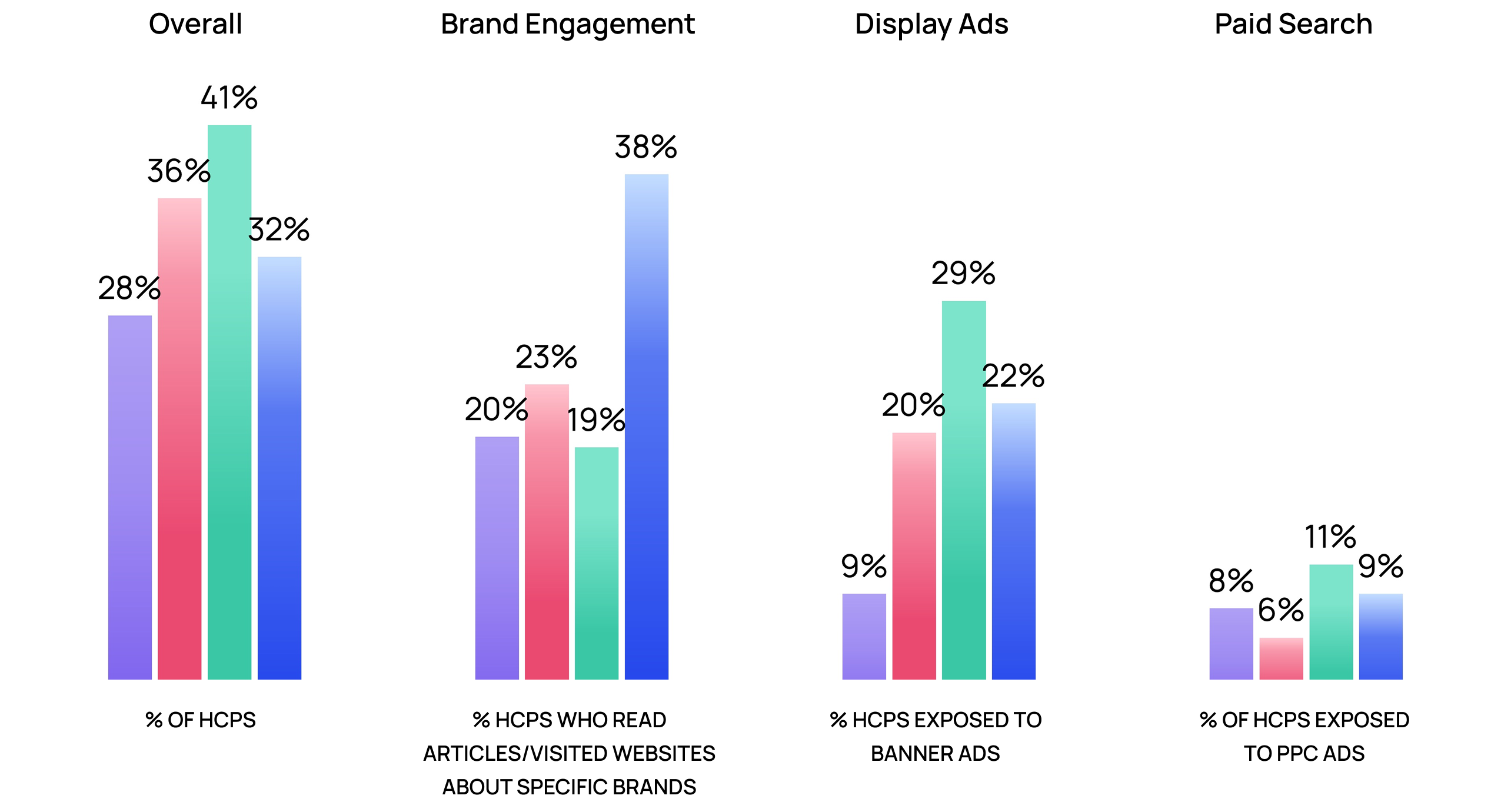

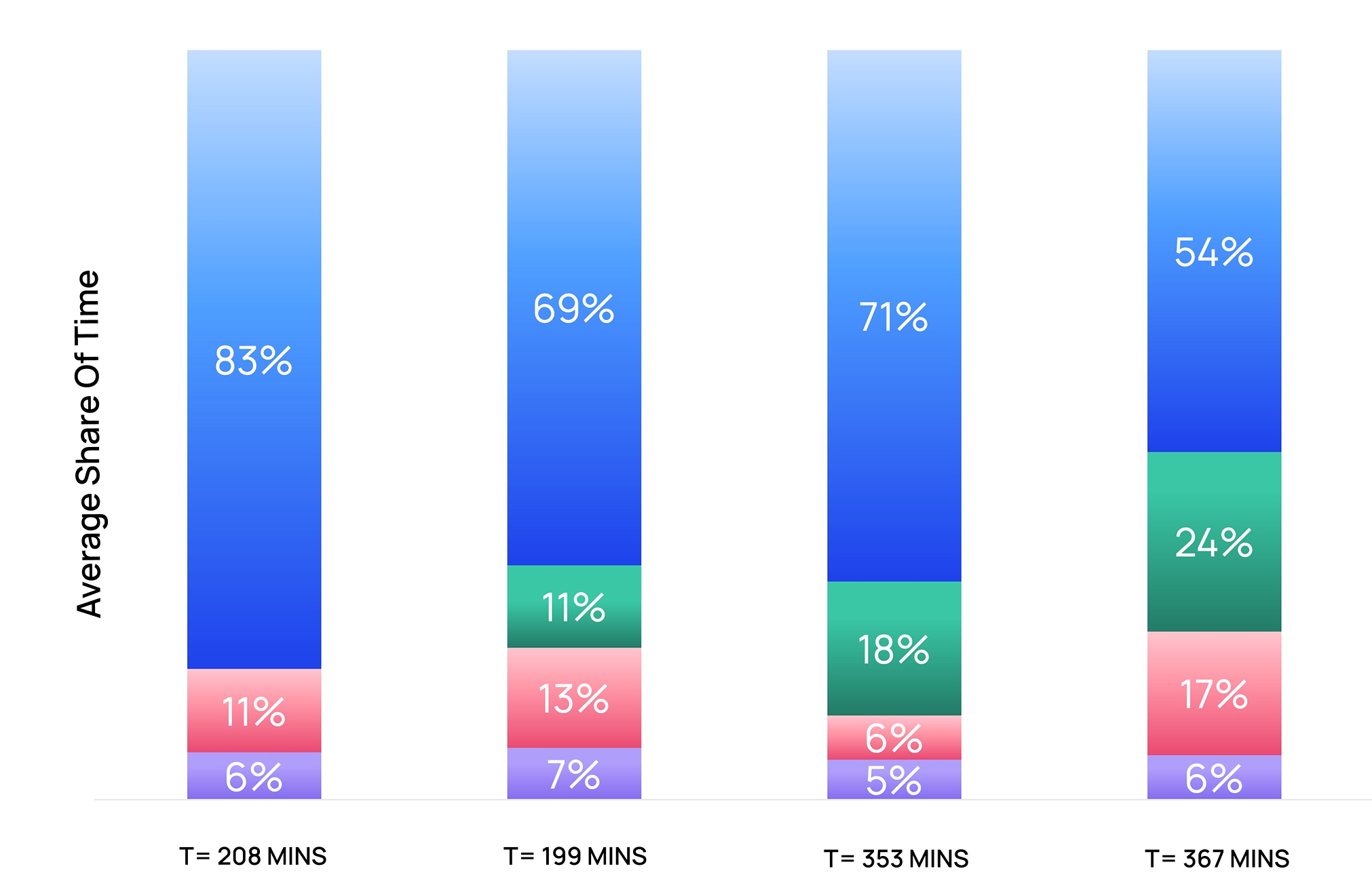

This study evaluates the effectiveness of digital and TV advertising for top GLP-1 brands by tracking HCP exposure, engagement, and shifts in attention over time to see how ad spending impacts brand presence.

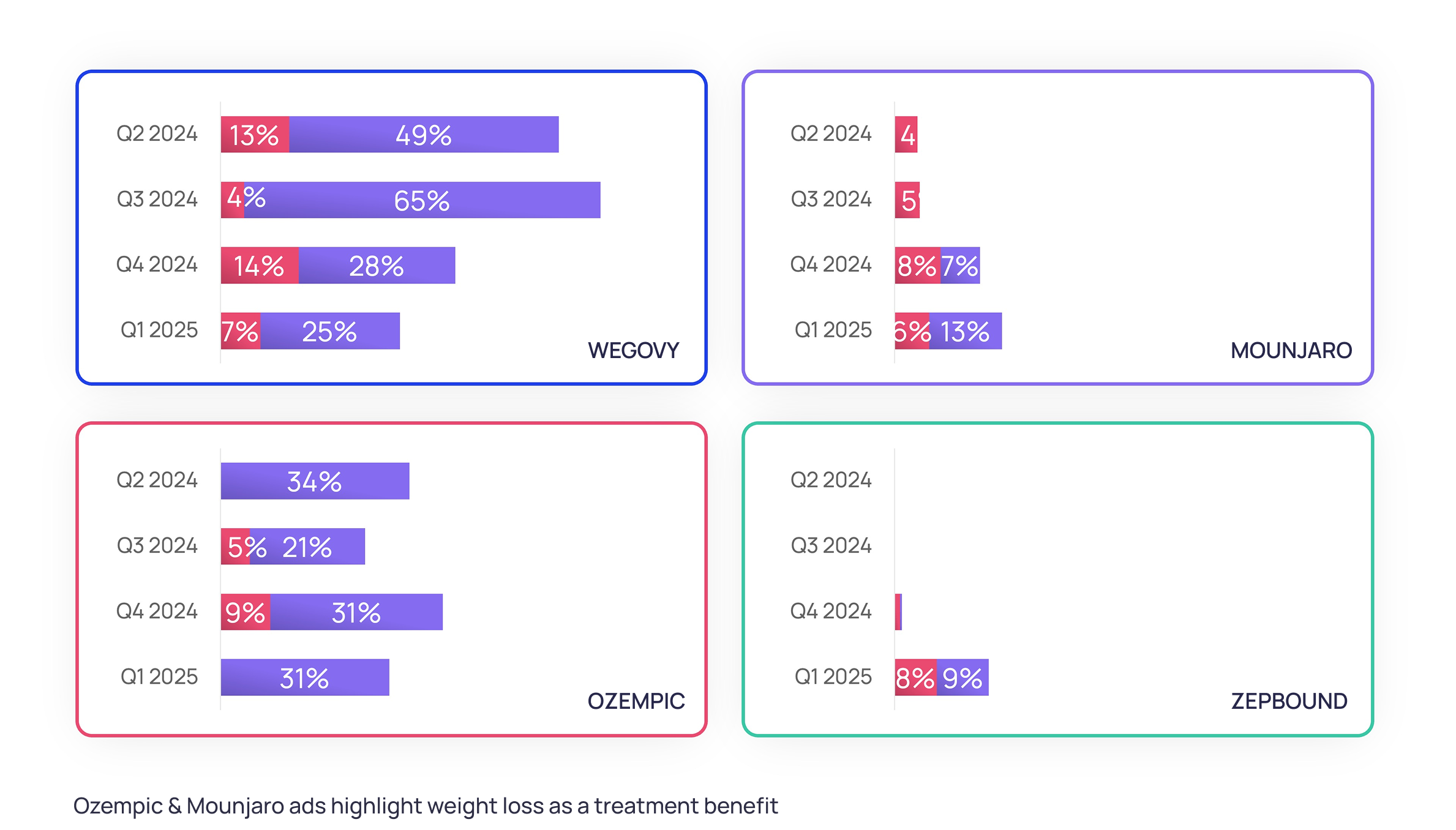

Zepbound achieved highest HCP digital reach at 41% and significantly outperformed competitors in banner ads, while eroding Wegovy's dominant share of weight-loss browsing time from 83% to 54% over three quarters.

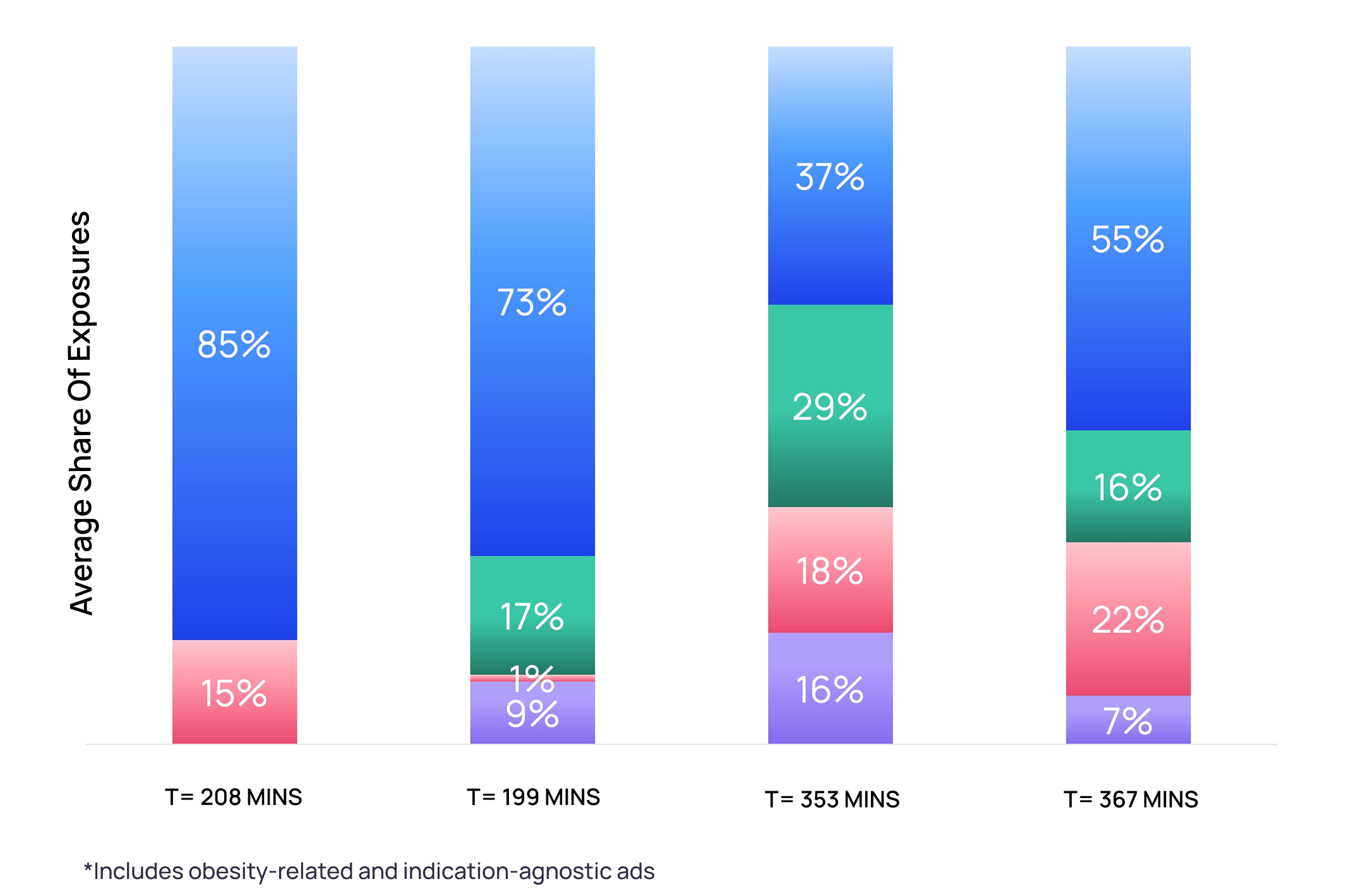

While Novo treatments capture over 75% of banner ad exposures and historically dominated CTV/TV with 65% share, Lilly's Q1 2025 Zepbound campaign surge is beginning to erode this traditional media advantage.

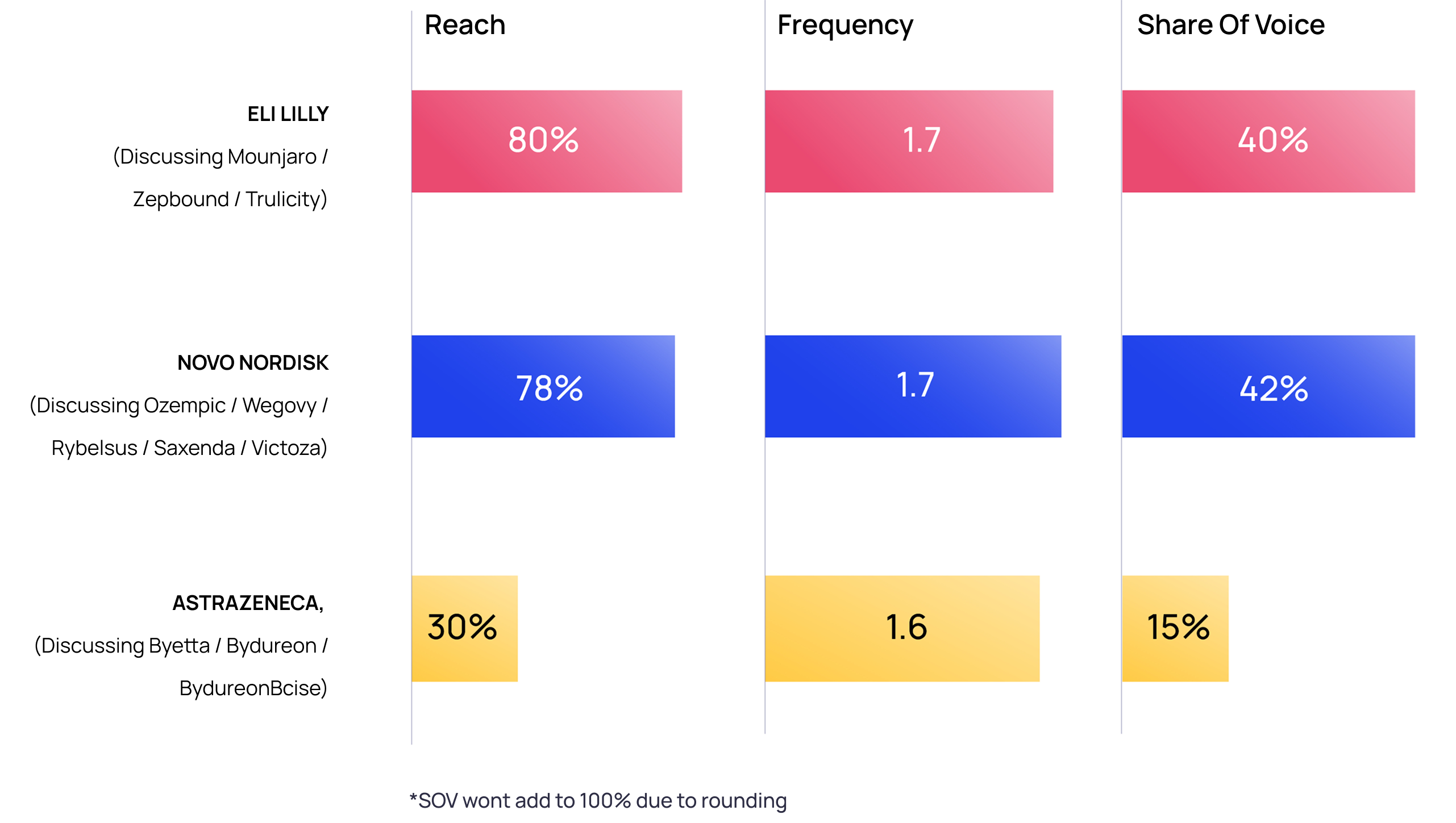

Eli Lilly and Novo Nordisk achieve nearly identical HCP reach (80% vs 78%) and share of voice (40% vs 42%), suggesting competitive parity in professional engagement despite different digital strategies.

ZoomRx offers a wide range of AI-driven MR tools to empower your team to push beyond boundaries.

LEARN MORE